If you are looking for a brilliant way to manage your money, read on to discover a savvy safe spending tool, which helps to stop your money from cheating on you.

Fancy schmancy smart TVs

I’d love a new television. One that does whizz bang things like reading my mind and serving up brilliant tailored snippets of entertainment and news based exactly on my taste. In the future, it would also be great if my TV (perhaps a robot) followed me around the house while I do my housework, made me a coffee and even helped put my kids to bed. I hear a savvy young Melbourne-based student is working on this for my actual retirement age (in 20 years or so) and I want to meet her now and hurry her project along.

Psst: Us mums want to retire like today, this minute…like – now.

We’re tired.

But since technology can’t help us just yet, I’ll personally settle for a simple 70-inch smart TV for a wall and with a remote control that hasn’t been smashed up before it fell behind the sofa. It would also be great if the remote came with batteries and a plastic cover for keeping those batteries in.

Four year olds – hmmm….

I don’t like paying even half of full price

Problem is, after checking out the latest and greatest deals both online and in store, I’m unwilling to pay current prices for these glistening contraptions. For such an old-fashioned machine that is the TV, (even with the supposed fancy-schmancy ‘smarts’), I still find the prices too high for my budget.

But then, what kind of well-meaning, hard-earning, lover-of-savings-blogger would I be if I ever dared pay full or even ‘less-than-full’ price?

Nope. I’ve done my research I’ve decided – I’m officially a Smart TV Scrooge.

Bank balances

My bank balance won’t have a bar of any overpriced consumer-shenanigans either. While I prefer to log into my online bank account and find a full and plump looking figure from those savings I’m making, I admit that we (the family and I) have taken a hefty hit recently from the home renovations that are our current reality.

Note: You can read my floor sanding horror story here if you’d really like the dirty and dusty details of what happened over the holidays.

Cheating words

Then there are those cheating words banks use, which are silly really.

You know the words?

Like when you grab the little ATM receipt and it says ‘available funds.’ What that receipt is falsely telling us time-poor and hungry-for-cool-stuff consumers, is that there’s much more money in our accounts than there actually is, and that we can go sick and go shopping!

Yay!???

Not….

These ‘balances’ lead us shamelessly down a path of false economy and straight into the malls of marketing-enhanced and rip-roaringly cool retail stores full of goodies, gadgets and dazzling consumer delights.

Here’s a hypothetical scenario to prove my point

This is what can happen and what does happen to consumers daily:

- Jimmy checks his account online on his phone

- He sees he’s got a stack of money

- He buys a new cool pair of Vans

- By the time he gets home a bunch of direct debits have come out

- He realises he couldn’t afford the Vans at all

- He’s forced to eat noodles for dinner

- He can’t afford to put petrol in his car the next day

- He’s late for work

- He gets in trouble from his boss

See how bad this could get for Jimmy….?

Look. Don’t get me wrong. There’s nothing wrong with Vans or noodles. It’s just that most of us don’t like to unwittingly push our funds to the limit like this because that just leads us down a crappy path – like what happened to Jimmy.

Thank goodness that poor guy wasn’t real 🙂

Your money is on the move

So, while you think you may be looking at a stationary figure on a screen or on an ATM receipt – beware:

Even while you are watching the figure on the browser that is your bank balance, your funds are being sucked up and spat out behind the scenes. The usual and numerous bills from utility, mobile phone companies and supermarkets are working hard, and pouncing on purses and wallets daily – in a silent, frenzied and money-eating ‘bank attack’.

Click refresh around 4pm and you’ll see what I mean…

Oh, and don’t forgot the fat stack of bills that might be sitting under the local paper on your kitchen bench.

They are an even bigger silent killer…

It’s not your fault

But don’t worry – we’ve all been there and it’s not your fault. Seriously, blame anyone but yourself. I do.

And remember: There’s always a snazzy little app that can fix anything these days.

Get savvy with your spending

Even though technology hasn’t served me up my robot yet for helping with the housework, there is help at hand for the daily, shameless ‘bank attack.’

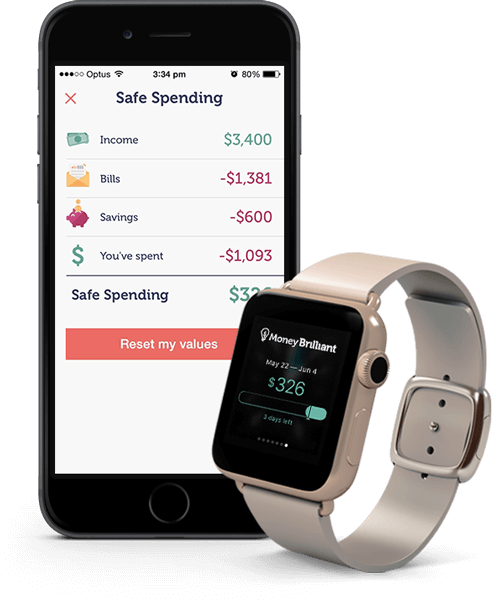

Try out this great little app called ‘Safe Spending’ from the smart people over at Money Brilliant. If you really want something cool and schmancy, get this app and use the savings you make to pay for a Smart TV!

Your money will never run away with you, from you or into the arms of someone else again.

Here’s what this baby can do

This brilliant app will do away with spreadsheets and the arduous task of checking bank accounts altogether. Punch all your bank accounts into this baby (to connect them up), as well as credit cards, loans, superannuation and investments. Then shortly, you’ll have a full picture of your finances all in the one place.

Oh, and if you’d like to check your money while doing the housework or indeed if you’re out and about shopping for a new pair of shoes, the app also works on Apple Watch!

Here’s what it does

- Takes your income

- Subtracts your future commitments (Bills)

- Subtracts your saving Goals (You set this)

- Subtracts what you have spent

And ta da!!! The result?

Drum roll please…

You’ll get a final figure or rather the ‘bottom life’ of what you can safely spend and happily today, this minute – right now!

Using this app, Jimmy could buy the Vans and maybe even take himself out for a steak dinner.

Nice one Money Brilliant 🙂

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE