Here are some phrases to ponder today:

- Home loan interest rates

- Cost of mortgage insurance

- House repayment calculator

Do phrases like this make your heart sink a little? Do you feel them in the pit of your stomach, like a bad tummy bug? For most people, the word ‘mortgage’ is cringe-worthy. It should be. The base of this word means ‘death’ and since death is a human’s biggest fear – I’m not surprised this word is scary. These days average Australians can’t afford to buy a home in the first place, let alone pay one off. It’s hard.

Today I’m talking about ways to save money on home loans.

Love a great story? Read on…

Discover the fatal mistake my case study couple made. Also learn how they can fix their finances and finally go on the Cruise Ship holiday they’ve always dreamt of.

Mortgage Lessons You Need To Know

The average hardworking time-poor Australian makes $78,832 per year. I’m going to round this number up to $80,000, to make this exercise easier to digest.

Don’t worry. You’ll learn a lot here today. Me? I’d rather be soaking in a hot tub dreaming of Fiji. But these tips are so life-changing – I’m glad I’m putting the hours in. I’m here at the library, sitting with a bunch of strangers, ready to give you the stuff of true money legends. Hold on to your hat and enjoy the journey…

Follow this strategy and you will win

Today’s task has reminded me how very important cleaning your money is. I always thank myself later. Hopefully, you will too. So grab a cuppa and huddle-in. When you’re sipping a Margarita on a cruise ship one day, you’ll be happy you spent the time here in the room today.=

Introducing Jim & Gina

For this hypothesis, I’ll use a guy I’m going to call Jim. Jim is a top bloke. A trim suit-wearing-spent-a lot-on-his-shoes type. He’s ageing well at 35. He has barely a grey hair in sight.

His girl Gina (a pretty blonde) is smitten by him. She can’t stop talking about Jim to her workmates. Sometimes they get a bit bored of the Jim stories. She can tell, but she spills them anyway. She can’t help herself. His mother, Gloria, thinks the sun shines out of this head. Jim can do no wrong in Gloria’s eyes.

He works as an HR consultant in a slick city building overlooking the Yarra. It’s an awesome view. He’s lucky. He is earning the exactaverage Australian wage. It’s uncanny.

Pay Day

Source: Pixabay

Jim gets paid each fortnight on a Thursday arvo. His pay goes in just in time for drinks at the local pub on the corner of his street in Fitzroy in Melbourne. There’s live music at the pub on Thursdays. A rocking acoustic band gets the crowd going. A good time is always had by all. Gina usually gets way too excited (and hence drunk) and he has to steer her all the way home.

Jim does what most people do and gets his pay direct debited into a bank. He deposits the money into a savings account, which is his all-in-one savings-and-slush fund. Let’s take a look at some of Jim’s average monthly expenses.

The Mortgage

Source: Pixabay

His biggest expense is, of course, the mortgage. He’s one of the lucky one’s who ‘got in early.’ He purchased a tidy 2-bedroom terrace in Melbourne some years back. He did pay a pretty penny for it and has still has a mortgage of $650,000 (the exact median price for a home in Melbourne). Again – uncanny.

He pays a whopping $2728 per month and has an interest rate of 3.6%. He’s stoked about the interest rate after remortgaging recently. He thinks his mortgage broker Bruno is awesome. Jim is always happy to recommend Bruno to every mortgage-stressed friend he meets. Jim is a lover of good karma.

Credit Card

Source: Pixabay

Jim also has a VISA card he’s put $12,000 on. He’s taken Gina on a few trips to Bali because life is short. He also loves her blue-green-grey eyes that change colour with her outfits. He took his mum once too. Gloria raved about it to everyone who called her on her birthday. And I mean, e-v-e-r-y-o-n-e.

He’s managing to pay on time each month but he still owes the $12,000. He’d love to get it down further but struggles to make extra payments with all the other expenses he has. His minimum payment per month is around $600 at a 21% rate. He hates himself for the rate. He’s been meaning to spend a day on the phone finding a better one but he hasn’t had the time. Sometimes, Jim loses sleep over his credit card rate. But, he promises himself he’ll get to it. It’s the next big, top, urgent, #1 thing on his list this month.

Other Living Expenses

Jim is paying out a heap (like most Aussies) for living expenses. He’s paying way to much for groceries. He’s throwing food into trolleys at supermarkets in a random act of human error. He’s getting blinded by their bright lights and happy packages. He wants to buy everything he sees. It’s all so colourful and beautiful, and since the prices are down, he thinks – yeah – grab it!

He’s not paying his electricity bills on time either. On a side note: He also gets traffic fines. Rush hour is hell and he keeps getting caught in the no-go-zone lane. He’s also always going over his data and the bills are piling up. Rates have gone up too, so his monthly living expenses, including his mortgage come to a total of around $5000.

Here is Jim’s true bottom line:

Source: Pixabay

For the sake of simplicity let’s say Jim clears $5000 each month after tax.

- Income: $5000 in (end of the month)

- Expenses: $5000 (end of the month)

Little does Jim know, but he’s so busy with work, hanging with Gina, and calling over to Gloria’s for dinner…he doesn’t realise this:

His cashflow is ZERO.

Those long days at the office aren’t actually getting him anywhere. He’s on a treadmill. The dragging 3pm minutes he spends watching the clock, aren’t worth the seconds they’re made of. But actually Jim has friends. He’s not alone in this situation. The bulk of most people living in Australia are on the same work-spend-debt treadmill.

This is their predicament:

- They’re broke.

- They don’t even know it.

- They’re too busy to find a better way.

- They can’t get off the treadmill.

- They think they’ve got money because they’ve got a credit card.

- They have zero money.

- They’re getting in more debt.

- Even though they’re all working long, hellish, traffic-filled, tiring days.

Here’s what would make this story happier

Source: Pexels/Pixabay

If Jim found a way to be like the 5% of the population who aren’t on a treadmill.

- The people with time to think

- The ones with enough money in their pockets to dine out weekly

- Those who can watch a sunset from the deck of a fancy boat (or pretty pier) without feeling squeamish over their credit card rate or bills piling up

If Jim was better off, he could sit by a pool with Gina. He wouldn’t be mortgage stressed. He’d relax with a beer in his hand congratulating himself.

Image: Licensed

He’d also have extra money (cashflow) to send his lovely mum Gloria a bunch of flowers every so often. She’s a wonderful hardworking woman. She’s been so good to him. She deserves more.

While I’m On The Topic Of Life Moments

Actually, while I’m here talking about Gloria and her blessed Jim, I should mention this. While researching this article I found this excellent new resource from National Australia Bank (NAB). It’s their new Life Moments Hub: Paying Off Your Mortgage resource.

It takes consumers through the stages of paying off a mortgage from a $200k balance to a $0k balance. You can work through the steps as you pay your mortgage down and it tells you what to do next. For example, at a $200K balance you can find out how to use your mortgage to help the family. At a $50K balance, you can find out how to use a redraw facility on your home loan. When you have a $0K balance you can discover ways to boost your super for example. You can also read stories on what other Aussies did once they reduced their mortgage balances. You should check it out.

Keep reading to discover how I used this great resource and applied it to Jim & Gina’s situation.

OK…Let’s get back to Jim & Gina

Let’s See If We Can Get This Lovely Couple Out Of Their Work-Life-Debt Rut

Let’s first take a look at the interest rates and the difference between interest rates on a credit card versus mortgage interest rates.

Credit Card Interest Rates

If Jim could reduce the interest rates – he’d be paying back less. The interest on Jim’s credit card is actually a simple equation. Banks don’t know how long it will take Jim to pay back his credit card or even if he ever will. So the banks set up credit cards so that interest calculates daily. They then charge Jim each month. In short, credit cards are a boomerang deal. As soon as Jim pays money in, he can take it straight back out again. He could buy Gina some perfume for her birthday or treat himself to a nice new pair of Adidas.

Mortgage Interest Rates

But home loans are different. The bank does know how long Jim will take to pay off his mortgage. In Jim’s case it is 30 years. It will take Jim longer to see his money boomerang back. Jim puts money in and it gets soaked up immediately into the mortgage. He won’t see his money again unless he sells the house for profit. He may never see it. He may die in it. His gorgeous kids-to-be might only see the benefit of Jim’s hard work when they inherit his house.

They won’t mind though. Because after Jim and Gina have the little darlings, they’ll develop a massive sense of entitlement. Jim & Gina will spend the kids teenage years wishing they never spoilt them rotten once. That’s because one day, the little brats will think the world owes them e-v-e-r-y-t-h-i-n-g….including Jim and Gina’s precious family home. Gloria (Nanna) wouldn’t be a help either in the long term. She will shower her grandkids with enough department store specials to put Santa out of business.

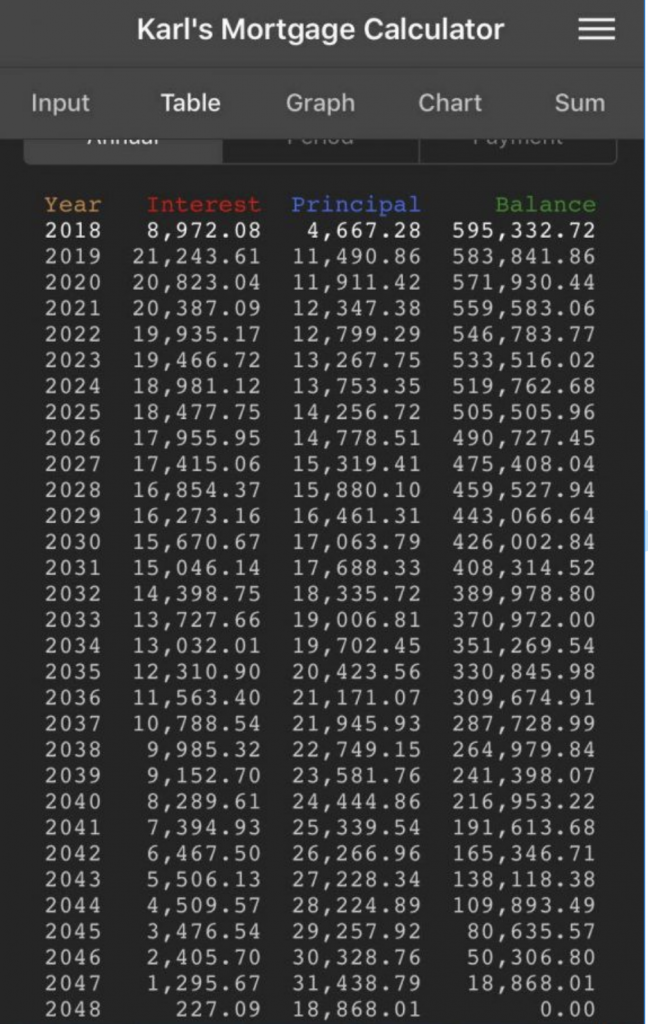

Here’s A Simple Way To Understand How Mortgage Repayments Work

On mortgages – the interest payments start off large and end up small. Paying off principle – starts off small and ends up large.

Here’s the rough breakdown of how this works for Jim & Gina’s mortgage.

Here – Interest is Winning:

- Year 4: Interest $71,245 Principle $40,481

- Year 8: Interest $76,859 Principle $54,075

- Year 12: Interest $68,218 Principle $62,438

Here – Paying off Principal is Winning

- Year 16: Interest $58,841 Principle $72,092

It will take Jim around 16 years before he really starts putting a dent in the principal payments on his mortgage. Of course, real estate is awesome because the house will go up in value over that time. So his investment is more than paying off. Using the bank in the first place, was well worth it.

He’s in the game, not out of it. So he can say a big fat thank you to the banks for that!

Kid-Wrangling

Source: Licensed

Now let’s say Jim & Gina tie the knot straight away, get married and have twins: a boy and a girl. They name them Marcus and Maria. Marcus is a ruff-n-tumble kid. It turns out he’s always in trouble. So Jim and Gina join Marcus up to Air Cadets as a teenager to straighten him out. Then Maria wants to join too, ’cause they’re well… twins. They do everything together. So now both kids are in Air Cadets.

As it turns out, despite what we thought might happen, Marcus and Maria turn out alright. They turn out to be quite independent types, and not having the sense of entitlement I described above. It’s a miracle really.

One night, Marcus and Maria get talking. They decide it would be a great adventure to leave home early. They announce their plan to their parents one night over dinner on their 16th birthday. Gina has cooked them both her remarkable Lasagna. The kids plan to get jobs in the Air Force at the exact age they can – at 16 years and 6 months and tell their parents they are moving to Darwin. Jim and Gina celebrate (on the inside) and again it is uncanny. How coincidental that their kids want to leave home. And, at exactly the same year their mortgage will start paying dividends? It’s amazing.

Of course, Gina pretends to her friends that she’s devastated her darlings are leaving home. But she’s not. She can’t wait to cash in on all the hours she put in as a mum. To watch her kids literally ‘fly’ while she spies on them on Facebook from abroad.

When Mortgage Repayments Kick In

Both Jim and Gina go to bed that night looking quite a bit younger. It is like their wrinkles have instantly disappeared. Gina rolls into bed a little later after catching a cruise ship sale. She’s always wanted to go to Tonga via Samoa. They might have the money and time now to lose the locked-up grind of domestic life. They might skip the slavery of washing and dishes and trade that life in for life at sea.

How wonderful.

On the Cruise Ship, they’ll watch a sunset together feeling bloated most days. That’s because they would spend each day at three all-you-can eat buffets. Gina will treat herself to Jam Bagels & coffee at breakfast. Jim will woof down an entire pizza at lunch as he hammers down beers like the drink is a whole new experience. They’ll admit, while watching that sunset, life had been a hard slog. Gloria was hard too. She didn’t age as gracefully as they expected. She stopped listening to them altogether and just did whatever the hell she wanted. Those years were hard.

They decide life actually is short. This sentence is no longer a saying they’d throw around like a wayward Whipper Snipper in need of fixing. But despite realising this they can also see that now life will be easy. They’ll be like two teenagers on a high-speed downhill skateboard ride. They’re cruising into a balmy wind, arms out, free as birds, with no oncoming traffic in view.

Well, the above is Jim & Gina’s dream scenario anyway….let’s get back to business

So let’s get back to Jim’s Amortisation Schedule. At Year 4 – He has only paid $40,481 off the mortgage. Here’s what would happen next. Jim will start to think: This is ridiculous! Why am I paying so much in interest? There must be a better way…

Jim’s Fatal Mortgage Interest Mistake

He’ll see that he is losing so much money in interest he’ll need to get that rate down. Everyone Jim speaks to (his mates at the pub, his boss Tom and their rich neighbour Bruno) tell him he needs to get that rate down. So, while Tom isn’t watching, he jumps on some comparison sites at work. He starts hunting down a mortgage broker. He finds a bloke with a good profile picture and 5-star online reviews.

His name is Dale and he’s keen to get over asap – on Tuesday night if possible around 7pm. He will absolutely, no probs at all, help get that rate down and get these two out of trouble.

Dale gives Jim & Gina a short list of the paperwork they need to gather before he arrives.

Source: Licensed

Now, everyone in this picture is happier. They’ve all jumped on a little lose-your-home-loan-rate merry-go-round together. It’s a win-win. Jim & Gina will drastically reduce their monthly mortgage repayments and Dale will cash in and get paid his commission. Dale is driving. Happy days…

But this is where Jim makes a fatal mistake. Don’t worry – the boss never found out he was surfing the Net and didn’t get fired. But he may as well have with the amount of money he’s about to lose.

Mortgage Reset Moment

Image: Licensed

By lowering his interest rate Jim has essentially ‘reset the clock’ on his mortgage.

Let’s take a look at this again:

- Year 4: Interest $71,245 Principle $40,481

- Year 8: Interest $76,859 Principle $54,075

- Year 12: Interest $68,218 Principle $62,438

- Year 16: Interest $58,841 Principle $72,092

Jim is now back to the beginning of the mortgage cycle they started with. So it will take him another four years to get back to making the Principal payments start working for him again. The interest equation will go back to the beginning.

Introducing Bruno – The Rich Neighbour

Well, lucky for Jim & Gina they have a chance meeting with their rich neighbour Bruno one sunny Sunday. Bruno has had a few beers and is feeling rather free with advice. With shovel in hand, this is the life-changing advice delivered by Bruno over the side fence.

Jim & Gina now have much to thank Bruno for.

Source: Licensed

Bruno’s delivery of this important information took a while. This is because Jim & Gina were taking notes on some old party napkins they grabbed from the shed. Luckily it was a boring but sparkling afternoon in spring, and everyone had time to hang around…

Step 1: Offset Account

- Open an Offset Account (lined to mortgage for the purpose of reducing interest payments)

- Pump all your money into the offset account

- This will bring the interest paid on the mortgage down with massive savings over time

- Increase the size of repayments and change from monthly to fortnightly or weekly (check loan conditions first)

- The more money Jim & Gina have in their offset account, the less they’ll pay in interest

- They should consider putting a lump sum in and not touching it – e.g $50k

- Because interest is calculated daily (not monthly) so adding regular money to an offset account will continue to help Jim & Gina pay their mortgage down faster

- They should try to keep the money in the offset account for a month or even more

Step 2: Credit Cards

- Use a credit card (with a long interest free period for day-to-day expenses) to pay for all living expenses each month

- Deposit Jim & Gina’s salaries straight into the offset account

- Use the money in the offset account to pay off the credit card balance

- Jim & Gina will continue to have reduced interest on their home loan over time

- At the end of the month make the usual mortgage payment

- Also pay off the credit card balance

- Rinse and repeat

Here’s how Bruno’s lesson works in theory

- Every time Jim & Gina get paid their offset account balance will increase.

- The balance will only decrease once a month when they pay the mortgage and credit card.

- Daily interest calculations will be much less

Step 3: General Extra Tips

Here are some general tips I’ve also discovered:

- Boost your repayments now to benefit later

- Make more frequent repayments (so move to fortnightly or weekly)

- After making extra income (e.g an eBay sale) put that money on the principal of your loan

- Shift a portion of your loan to a variable rate

- Calculate how much you can save (be realistic) and make regular payments into the mortgage

- Discover new ways to save and use them daily (e.g paying bills on time)

- Rent out a spare room or use your skills to increase income (always get council permission first)

Tonga via Samoa: Dream Cruise Holiday

If Jim & Gina continue to take Bruno’s advice (and use NAB’s fab new resource I found), they will pay their mortgage off much faster.

They’ll have enough cashflow to actually go on that dream Cruise Ship holiday.

Source: Licensed

Happy Days!

They’ll be sure to send their loving neighbour Bruno a postcard from their spot in the sun on the island of Samoa.

Read more about how you too can pay off your mortgage faster at NAB’s New Life Moments hub.

This article is a NAB paid promotion and was written in collaboration with NAB. As always, all opinions are my own

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE