I’m taking a break from the domestic bliss of motherhood and penny-pinching today to learn more about investment. Since EOFY has just past, I’m going into fully-fledged ‘money mode’ this month, as I do every year- just before June 30 hits.

This week (aside from the renovation and looking for a mortgage broker), I’m on a mission to demystify some modern investment ideas and put them into a language and format we can all understand.

Recently, I was invited to attend a webinar on “Strategies for Positive Returns in Volatile Markets.” As a mummy blogger I wondered how I’d go sitting in a webinar where the language and concepts seemed complex. But once I cut through the jargon – I realised these concepts were fairly simple to understand.

Read on to discover what I learnt at the webinar including the concept of Absolute Return Investing and how investment solutions companies are leveraging savvy skills and systems to make wins for their clients in today’s volatile markets.

The webinar that I attended was hosted by a company called Netwealth they’re a business that provides their customers with access to something called a ‘super and investment platform’. To simplify what that is – it’s basically an online site that helps people to manage their own superannuation (yes, you can do it yourself!) and investments (things like stocks in companies, term deposits, and professionally managed portfolios that you can buy into).

Each month Netwealth hosts a portfolio construction webinar where they invite a professional investment portfolio manager along to speak about a particular investment strategy or concept – it’s a way to help people who want to be in control of their own super and investments to get a better understanding of how they might go about the process.

I know, it might sound a little bit complicated! But I found out at the webinar that the concepts are easier to understand than I thought they’d be!

This month’s Netwealth webinar was aimed at anyone who is concerned about current market conditions, and the presenter was from a company that has investment options available through the Netwealth platform, they are called Prime Value – and they basically manage investments on behalf of people. This article is a case study on what I learned during the session about a strategy for investing to safeguard your portfolio during rocky times in the stock market.

The ‘Absolute Return’ Investment Strategy

So, the investment strategy that was presented by Prime Value at Netwealth’s webinar was ‘Absolute Return Investing’. But what on Earth does that mean?

Firstly, the goal of Absolute Return Investing is to produce positive returns over a period of time, whether or not a market is stable or not. Further, this style of investing deals with the return of an asset, which is not the case with other strategies like Relative Return Investing.

Here’s Wikipedia’s formal definition of Absolute Return Investing:

The absolute return or simply return is a measure of the gain or loss on an investment portfolio expressed as a percentage of invested capital.

- Let’s go back in time a little:

Traditionally Long-Only Equity Funds were popular

Forbes report the following:

The logic behind long-only equity, that risky assets deserve higher growth potential and straight market exposure will provide acceptable returns, works well in the ivory tower of modern portfolio theory, but often takes decades to deliver results in practice. Those who believe in active management make the additional assumption that manager judgment can add significant value over time. Few investors have enough patience for either of the above to hold true.

Absolute Return Investing is becoming a popular trend because the funds are NOT linked to any particular share market index.

Here’s the brief on why Absolute Return Investing is gaining popularity:

- Returns – In unstable economic growth environments equity market returns can be volatile

- Opportunities – Benchmarks can be inefficient and ‘backward looking.’

- Diversification – Absolute Return Investing can have low correlation to equity markets

- Preserve Capital – Lower volatility offers downside protection

- Complements – Can complement long only funds and direct holdings

Investing in volatile markets

Firstly, there’s a focus on stock selection, which is important. But this is only half the process. The other half of the process is portfolio construction.

Professional investment portfolio managers, like Prime Value, use their expertise to research the best companies to invest in on behalf of their clients. Of course, their goal is to maximise the investment and NOT lose money in the stocks that are invested in.

According to Prime Value these factors are important:

- Diversification of equity risk is a key capital investment feature

- Balancing these features so the portfolio is both diversified and opportunistic in the market

- Focus on Absolute Returns and risk is the best way to get this balance right

Portfolio Construction

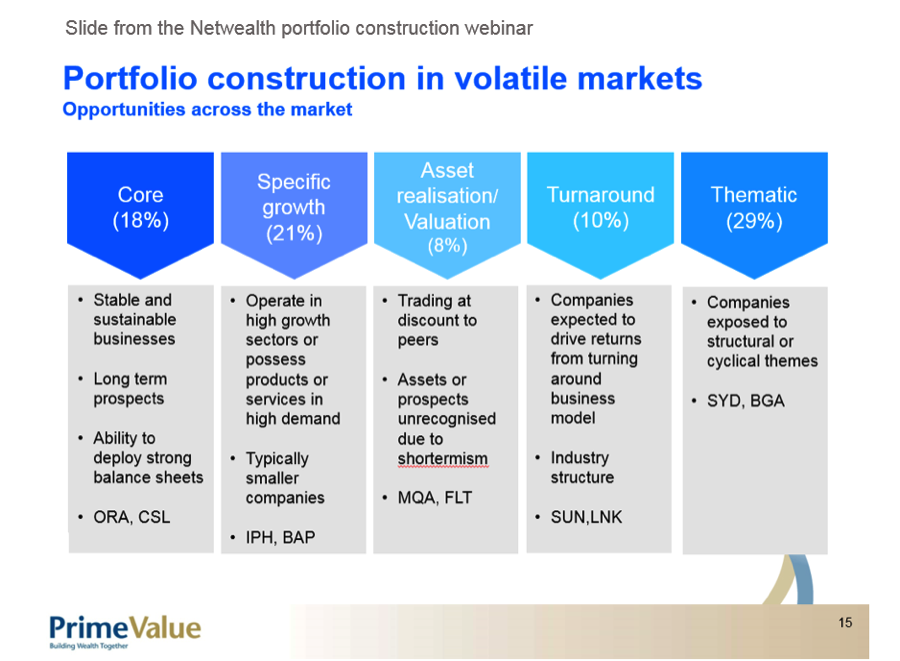

Opportunities are segmented into five key sectors such as below. This is quite different from a typical index.

This is how companies are categorised and the portfolio is built out and constructed. Then this is put into practice with stocks and companies.

These are the kinds of opportunities that portfolio managers might look for and analyse on behalf of their clients:

- Strong market position

- Mature industry structure

- Weakening competition

- Ability to consolidate

- Good management

- Market leaders

- Steady and sustainable earnings

- Strong balance sheets

- Efficiencies in business and developing new markets

- Excellent dividends and yields

- Exponential growth

- Large fixed subscriber base

- Ownership of infrastructure

- New markets

- Leverage scale

- Acquisitions

- Scope for operating cash flow growth improvements

- Deep and focused management strength

- Balance sheet with excess capital requirements

- Insurance industry structure is positive for revenues

- Positive outlook

- Reduced capital requirements

- Improved returns on capital

- Simplifying complex groups producing clearer lines and focus on profitability

- Asset developments

- Asian investment into Australia

- Major gateways and beneficiaries from Asian investment (E.g Sydney Airport)

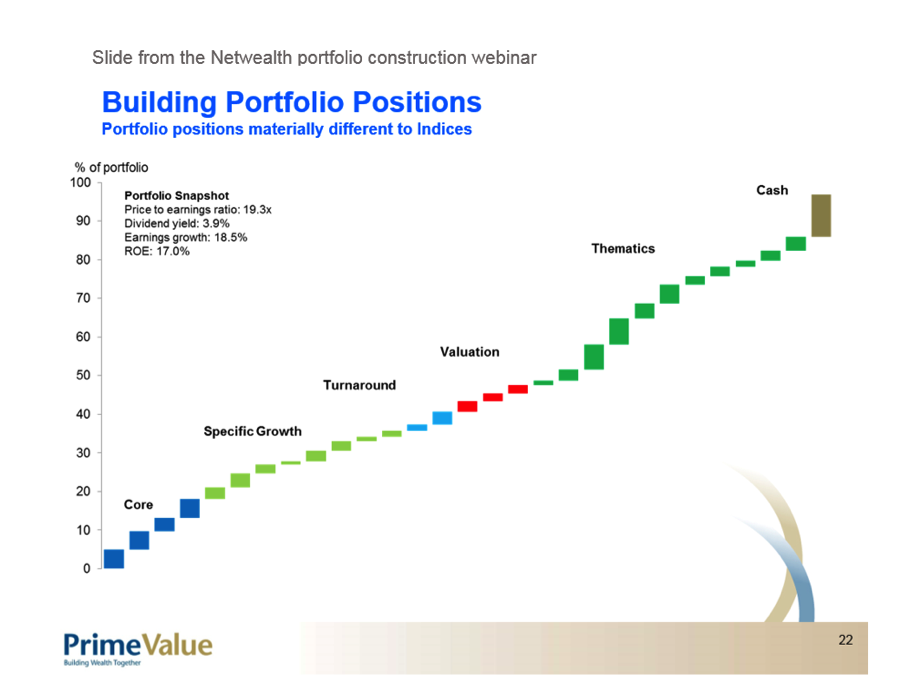

A typical portfolio is robust and quite different from an equity fund. They look for core companies with sustainable earnings and build out the portfolio from there.

In summary, they start with Core and end with Thematics – to build out a client’s portfolio. See image below.

Investment Philosophy

The goal is produce positive returns for clients

- The focus is on company fundamentals, constructing diversified portfolios and ability to hold 100% of the Fund in cash

- Aligned interests – Avoiding exposure to unfavourable climates

- Minimising mistakes by identifying winners and avoiding losers

- Focus on fundamentals such as management (as operators and investors), quality and growth of the business over time, transparency of the business and attractive valuations

If you’d like to learn more about this investment strategy for achieving positive returns in volatile markets visit Netwealth’s website to watch the full webinar recording.

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE