Let’s face it. None of us like to rip up cash and throw it into the wind. But did you know that you could be doing just this – if you haven’t considered salary sacrificing. Think of salary sacrificing like money that you’ll get your hands on instead of the taxman after you’ve slogged it out all year.

I’ve been learning some super tips from Suncorp Super on the topic. Read on to discover the many benefits of salary sacrificing and how you can make the humdrum topic of saving for retirement more interesting via Suncorp’s new interactive game.

The next five minutes could be life changing

For some people, the topic of retirement and superannuation can be as painful as the thought of sitting in a dentist’s chair or watching paint dry. But once you learn more about the benefits of salary sacrificing you’ll discover that the topic becomes more interesting once you realise the kind of money you can accumulate through the simple action of setting this up.

Reading this article might take you five minutes – but these tips will make you smile when you are sitting pretty on a cruise ship in your retirement not having to worry about where your next Pina Colada is coming from.

Get my drift?

In my case, that will be a Penina Colada – ha!

Before you get started

Wouldn’t you prefer to learn about super and salary sacrificing through a cool new game?

Check this out from Suncorp Super, which you can play while watching telly or hanging with the kids – it makes learning about superannuation fun and interactive.

Tools like this are a great way to tackle a complicated subject!

What is salary sacrificing?

When you get paid every week, you receive a certain sum of money that is taxed before you receive it. If you salary sacrifice, you will give up some of that money first, which goes into your super fund, and then you will be taxed on the rest.

I’ll cut to the chase and just show you the money. I know you’d rather be playing on Facebook or blobbing in front of the telly, than learning this stuff – but seriously, once you look at the dollars, you’ll be hooked on the idea.

These extra dollars will come to you in two ways:

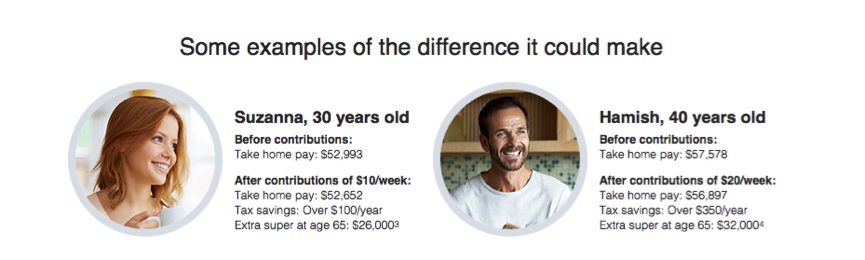

- You’ll make tax savings each year depending on your contribution. Say $100, $350 or even $608 as in the cases below.

- You’ll get a nice extra chunk of money when you hit 65 to take that world cruise or do up your granny flat with some hip new furniture. Say $26,000, $32,000 or even $50,000!!!

See how salary sacrificing just $10 per week (Hamish below is doing that) could mean you save $26,000 extra.

I hate to say this, but I will:

Life moves really fast.

I’m 44 and feel like I just had my 14th birthday – seriously. This is something you need to think about now. I do know where all that time went and I’ve had a heap of fun, but my goodness that time is flying by faster now that I’m older and life is a mad flurry of kids, friends, events, renovations, work, pick-ups, drop-offs and more.

Here are those nice people I mentioned above and how they are saving:

Source: Suncorp

Why salary sacrifice?

I have to say that those dollars should be enough for anyone to consider salary sacrificing – but if you are a real ‘but why?’ person, here’s the why:

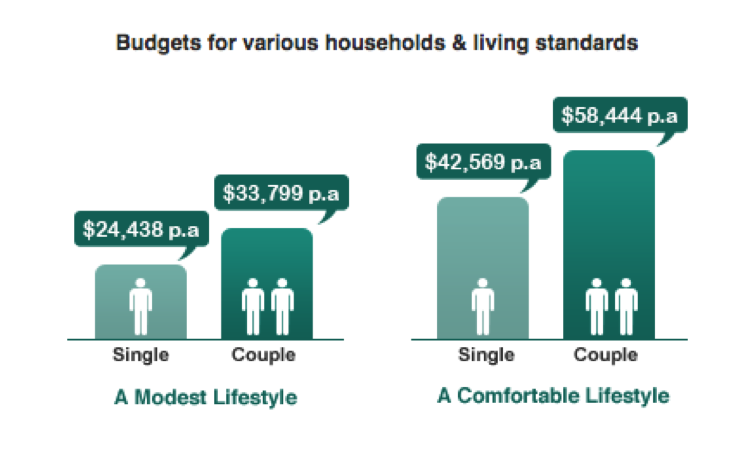

Did you know that if you want to live comfortably in retirement (i.e. turn the heater on and eat the occasional steak), you’d need a certain amount of money.

The good news is – there are plenty of people out there who have gathered up these statistics for you, so you don’t have to work this stuff out.

Here are some of the sad and staggering facts about funding retirement:

Modest Retirement

If you are a couple, for example, you’ll need $33,733 per year to enjoy a basic lifestyle. This means turning that heater on (paying those soaring utility bills) and eating a steak occasionally (that’s if steak is even on the menu by then – with the equally staggering grocery prices today).

Here’s the bad and sad news:

After all the hard work we all do (which includes our employers contributing a whopping 9.5% of our salaries to super) – most Aussies will still not have enough money by the age of 65 to live simply in retirement i.e pay all the bills and retire from work.

What? No Penina Coladas? Now, that is sad.

Comfortable Retirement

So, if you want a more comfortable retirement (i.e. turn the heater on, eat a steak, enjoy a Pina Colada, and take a couple of holidays each year), you’ll need $58,326 a year.

Now that’s a super balance of $510,000 by the age of 65!!!

Excuse my surprise but this is a little scary. I’m just quickly calculating the 20 years I’ve got left before hubby and I pack our bags and head to the Bahamas.

We best get moving on things.

So here’s the big point

Best not rely solely on your employer’s 9.5% contribution. While this is a fare chunk of a person’s pay – as you can see, this is piddly in the whole scheme of retiring comfortably.

Check out the following estimates for singles and couples

Source: Suncorp

What’s the answer?

You’ll need to make extra contributions, and like what Hamish is doing above ($10 a week), they don’t have to be big. This simple trick will make a big difference to your bank accounts in retirement and give you the comfortable lifestyle you deserve.

Yay – Heating, steak, holidays, the Bahamas and Penina coladas for moi!

List of quick benefits

So, in summary and aside from those nice holidays I speak of, here are the benefits of salary sacrificing:

- Here and now: You’ll save money each month by not paying as much tax. You’ll pay just 15% on the money you salary sacrifice (before you get paid). You won’t pay the higher income tax rates of 19c, 33c, 37c or 47c (depending on your salary). This means you can save anywhere from 4c to 32c per dollar and this certainly adds up.

- Later: You’ll get enough money to help you retire comfortably because of compound interest. That’s when that piddly $10 is worth substantially more over a long period of time. (Read the wiki)

How much should you sacrifice each week?

As in the examples above (our friends Hamish, Camilla and John), the more money you pack into your super now, the nicer your retirement will be in terms of extra cash.

Let me demonstrate the point this way:

If you eat the burger and chips now, you might not fit your jeans by summer. If you eat the fish and salads – you’ll hit the beach feeling fabulous.

Don’t you just love consequence?

And this point is very important for your retirement age.

Hey! Salary sacrifice and eat the salads – and you’ll be cashed up and fabulous by 65. Now we’re talking!

How much to sacrifice

So, how much to put into your super depends on your circumstances. If you think of the amount you could sacrifice in terms of some everyday luxuries – you might find you can contribute quite a lot. My entire blog is built on what money gets wasted every day and how to avoid cutting up cash and throwing it randomly into the wind.

Here are a few ways you can find an easy $10 or $20 to throw into your super for retirement:

- Skip one bottle of wine each week – $10

- Skip a few takeout coffees – $10

- Skip family takeaways each week – $10

- Skip buying one lunch out each week – $10

- Put back those random purchase at the supermarket – $20

See how it can all add up? If you did all of the above – you’d have a spare $60 this week!! If you bought yourself something nice for $40 and then took just $20 of that – you could do what Camilla did and turn that into $350 in tax savings this year and $32,000 in super. WOW!

Tips for calculating how much

- Talk to a financial advisor or accountant

- Get a rough idea using retirement calculators

Your idea of retirement will be different from mine. You might be planning to cash up and move to the country, open a museum, set yourself up in a retirement village or Grey Nomad-it around Australia. Whatever your plan, these calculators are great for estimating what you’ll need to live your exact retirement dream.

Moneysmart’s Retirement Planner is good and helps you decide:

- How long you live

- What type of lifestyle you want

- Future medical costs

Go nuts. Hope it spits out a nice answer for you…

Limits

There are some limits on super contributions you need to know about and here some quick facts:

- $30,000 a year limit on the concessional taxation of contributions to super from your pre-tax earnings.

- If you are age 49 or older on 30 June 2015, your limit is $35,000.

- If employed; your $30,000 or $35,000 limit includes the 9.5% your employer contributes to your super on your behalf each year.

- If you go over your limit you may be able to withdraw these extra contributions and have them taxed at your marginal tax rate, plus an interest charge (penalty).

- After tax, you can contribute $180,000 a year

- Many super accounts allow you to make contributions for your spouse (married, de facto or same sex). This might be necessary if your spouse has a low income or no income. If your spouse earns less than $13,800 you might be eligible for a tax rebate of up to $540 each year. For this, your spouse must be under 65 years or 65-69 and worked 40 hours in a 30 consecutive day period in that financial year.

Note: Before-tax contributions include salary sacrifice, Superannuation Employer Guarantee and other employer contributions.

Source: Suncorp

Forced savings are good for you

Think of contributing extra into super like forced savings you never have to worry about. This is because the money is taken out of your pay before you see it or your pay hits your bank account.

How to salary sacrifice and add more super to your life

Your employer will pay it straight into your super. Just ask your employer or HR department to divert some of your pre-tax salary into your super account each pay.

Note: Salary sacrificing is not suitable if you are earning under $50,454. An after tax contribution may be more effective as you may be eligible to receive a government co-contribution.

Action It: Ask your employer for the form. Fill it out. Job done!

Here’s another great example of how salary sacrificing works

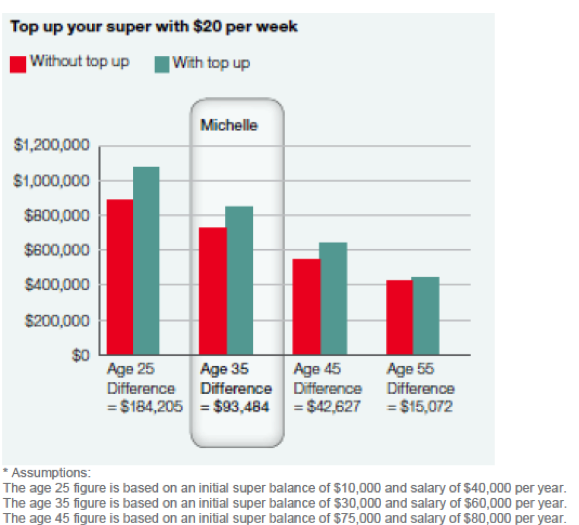

Michelle

- Michelle (aged 35) earns $60,000 a year

- Her super balance is $30,000

- She salary sacrifices $20 a week

- Her take-home pay drops by just $13 a week

- She will have an extra $93,484 when she retires

The following chart shows how Michelle could benefit from topping up her super with just $20 a week. The chart also shows the effects of a 25-year-old, a 45-year-old and a 55-year-old doing the same.

Source: Suncorp

See what Suzanna and another Hamish are doing

Image source: Suncorp

Final thoughts

I hope I have made the boring topic of salary sacrificing and superannuation a little more interesting for you. Remember that every snippet of information you learn is education.

And here’s my final equation for today:

Education = More Super Money!!!!

I highly recommend spending the time, putting more resources in your financial toolbox and becoming as educated as possible on the topics that bring you prosperity.

You won’t regret this and maybe you’ll even thank me one day, when you’re older – sitting on a beach or near a pool enjoying your retirement.

I know when I’m 65 hanging out in the Bahamas with my hubby – I’ll be raising my glass of Penina Colada. I’ll be thanking myself for doing that ‘two minute job’ – 20 years ago.

Gotta love consequence!

Q&A’s from Cathy Duncan

Can self-employed people salary sacrifice?

Self-employed people can claim a tax deduction for their super contributions. Most people can contribute up to $30,000 per year and the tax benefit will be similar to an employee salary sacrificing.

What happens if both partners aren’t working and are on benefits?

For those who aren’t working, and can afford to put some money aside, they can contribute these to their super fund.

What’s the average amount people are sacrificing?

It really depends on your own circumstances and what you can afford to put aside. If you are getting serious, you might like to contribute up to your contributions cap.

Cathy is Executive Manager, Superannuation – Customer Distribution with Suncorp Life

What are your plans for retirement? Share your thoughts in comments below.

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE