We are a laid-back bunch here in Australia. We love to arrive at parties in the latest and greatest car, consume platters of food and copious amounts of alcohol while standing around a BBQ discussing our beautiful home and latest renovation projects. We are a lucky country but it is actually quite astonishing to look at the facts about how Australian’s are actually paying for this premium lifestyle.

What’s the damage?

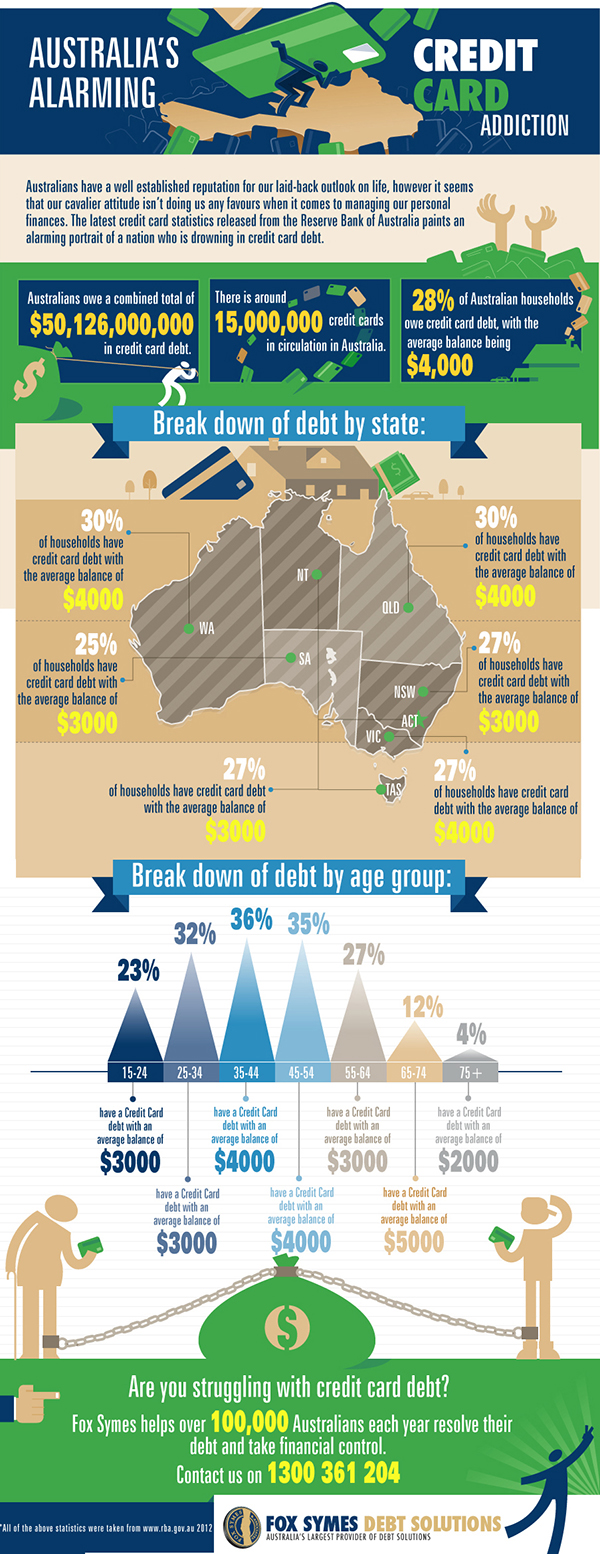

Recently the Reserve Bank of Australia released it’s latest stats on just how Aussies are paying and the humble credit card is to blame! In total us Aussies owe the banks $50,126,000,000 in credit card debt. Woah….now, that’s a huge cost for a little lifestyle indulgence!

How many cards exactly?

Even more astonishing is the number of Aussies who own credit cards! These average out at around 15,000,000 equating to 28% of us walking around with a little plastic fantastic in our wallets.

State credit card culprits

And if you really want to get down to the nitty gritty – let’s take a look by State! Our biggest spenders are our friends in Western Australia and Queensland. Households in these areas have an average balance of around $4000!

And as for age?

People between the age of 35-44 are the biggest spenders with an average balance of around $4000 too.

What about me?

But not me. Oh no. I do not fit into any of these categories because Mrs Smarty-Pants-Me cut up her last credit card in 2004! That’s right. That was the last time in my life I ever owned a credit card and I’m very proud of it. I’m a Debit Card lover myself.

Just how naughty this nation has been

Check out this fab infographic, which gives an awesome visual portrait of just how naughty we’ve been as a nation! Sure get’s one thinking….

This infographic was supplied by Fox Symes

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE