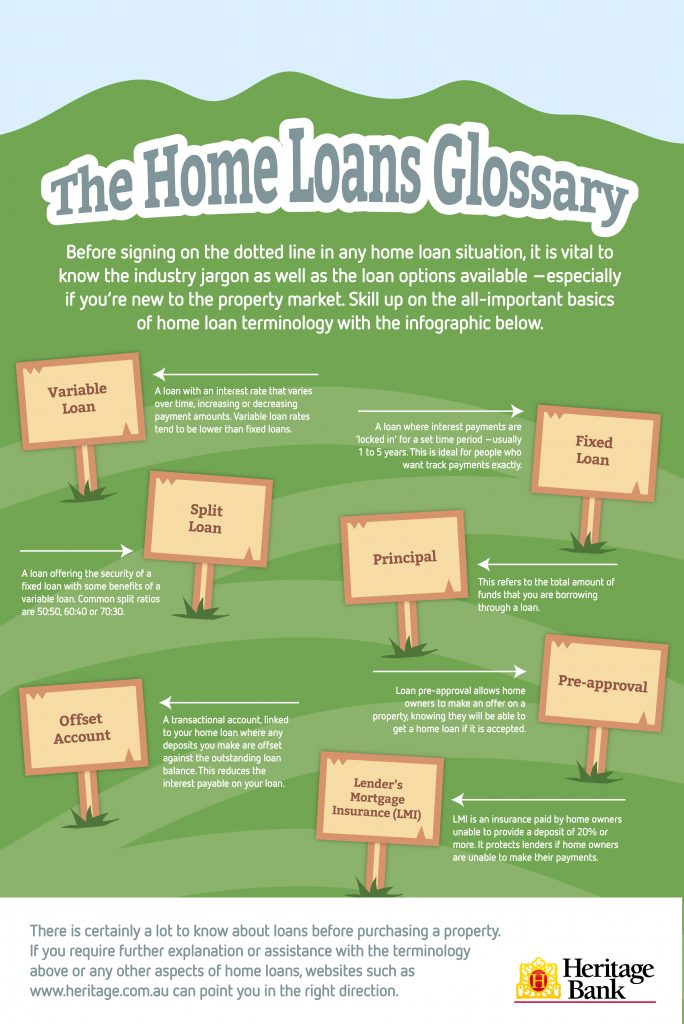

Purchasing a home and taking on a home loan is a big undertaking, so it’s important to have a detailed understanding of the process involved and the terminology that comes with it. For some people, entering into a home loan can be almost like learning another language, as many of the terms are completely foreign. If this sounds like you, don’t fret – below you’ll find a number of common home loan terminologies deconstructed and demystified.

Variable Loan

If you choose a variable loan, the interest rate will vary during the life of the loan, meaning your repayments could increase or decrease at any point in time. Despite the lack of security, this is a popular type of loan with home owners as interest rates are likely to be slightly lower than what you would receive for a fixed loan.

Fixed Loan

With a fixed loan, interest rates and repayments are ‘locked in’ for a set period of time (usually between 1-5 years). This type of loan is ideal for those who wish to know exactly how much they will be paying, whether this be for security or budgeting purposes.

Split Loan

Want to hedge your bets? Take your borrowing and split it between a fixed and variable loan. Many lenders will allow you to dictate the percentage of the split, whether you decide to go for 50/50, 80/20 or 20/20.

Principal

The principal is simply the total amount of funds you are borrowing.

Pre-approval

Want to be able to put an offer in on a property, knowing you are all approved to get a home loan? Before you even find your new home, you can do the necessary paperwork and ascertain whether a particular bank will approve your future loan application. The property market can move notoriously quickly and those with pre-approval have a distinct advantage over those whose finance may fall through.

Lender’s Mortgage Insurance

Lender’s Mortgage Insurance (LMI) is an insurance premium payable by home owners who are unable to provide a deposit of 20% or more. LMI acts as an insurance policy for lenders, in case borrowers are unable to make their repayments.

Offset Account

An offset account is a transactional bank account that is linked to your home loan. Whatever money you deposit in that account is offset against the outstanding loan balance, thereby helping you to reduce the amount of interest payable on the loan. Many banks, such as Heritage Bank, offer offset accounts to accompany their home loans and to help customers reduce their overall debt levels.

Terminology can be tricky to remember, and confusing to understand in detail even if you do happen to remember the actual name. This is where financial professionals can be helpful in explaining each item to you, and offering fact sheets or glossaries with a breakdown of all terms that might be involved in your home loan.

The Home Loans Glossary

Are you new to the world of home loans? What was the most effective way for you to learn all the new concepts? Comment below to share your thoughts.

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE