There are many reasons to save money like saving for a dream home or a reliable car. But have you thought of the other less obvious reasons for saving money?

Here are some reasons that will get you thinking outside the square:

Saving money will

- Lower your stress level

- Give you independence from others

- Give you a better lifestyle

- Gets you out and about because you can afford it

- Helps pay bills on time so you don’t end up paying more

- Helps you to take advantage of sales opportunities

- Helps you deal with emergencies

- Make you generally feel good

- Build self esteem and confidence

Keep reasons for saving money in the back of your mind are a great idea.

Action this right now:

Write down your top 10 reasons for saving right now and then read on to discover how you can achieve those goals and fast!

6 top secret tips for successful savings

1. Set clear goals

Definitely have clear goals in mind and write them down with timelines attached. Once a goal is written down it becomes embedded in your subconscious so that even while you are nodding off to sleep at night or going for a run, you will be thinking of those goals. By attaching timelines you will have those goals in mind when planning events. This way you can make all your life goals a ‘win-win’ as your goals will be complimentary. If you find your goals are conflicting e.g A night at the pub might stop you meeting your savings goal this week – this action will help you reevaluate what you are doing so you can make adjustments to your current situation to meet those goals.

2. Know what you want to achieve

Be clear about what you want to achieve. Write a list of priorities and get your head around what is important. Make the four items on the top of your list a priority and set your goals accordingly. Currently hubby and I are doing a renovation. This is a priority because we want a more beautiful home to hang out by summer! We’ve got a weekly ‘big thing to do’ on our family calendar to help keep us motivated when the going gets tough.

3. Tell others what you are doing

Telling other people what you are doing is good for motivation. This works because the next time you see that person you told they will ask ‘How’s the home deposit coming along?’ or ‘Have you bought a house yet?’ Friends, family and acquaintances are great for not only keeping you on track with your goals but also supporting you as you achieve them. ‘Putting it out there’ is also a great way to ‘ask the universe’ what you want and you know the old saying ‘Be careful what you wish for.’ Big things can happen with the right attitude!

4. Set up a savings account you can’t access

I use Ubank for putting away all my savings. Ubank is an online bank where you can set up categories for the items you are saving for like ‘Home Deposit’ or ‘Holiday Next Year.’ You can name the accounts whatever you like. Then set up a direct debit from your main bank account and then set and forget. And yes, life is busy, so you will forget about the accounts and be happy and surprised when those savings add up without you realising!

5. Use technology to put goals into action

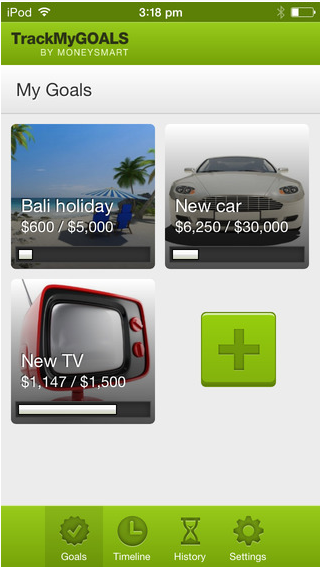

There’s no time like the present and one of the fastest ways to get started is by downloading a FREE and fabulous app, which was recently released (11 Sept 2014) called TrackMyGoals by MoneySmart, a division of the Australian Securities and Investments Commission (ASIC).

TrackMyGOALS helps consumers do this:

- Set, plan, track and manage savings goals and visualize your progress towards achieving those goals.

- Cultivate good savings habits

- Create realistic savings goals

- Prioritise goals to ensure they are reached

- Get positive encouragement through progress tracking

- Helps track savings for a holiday, wedding, car, house, renovation, school fees or anything else you can dream of.

Note: The TrackMyGOALS app appeals to a wide range of users from adults to children and even people who have never saved before.

Read more about TrackMyGOALS here.

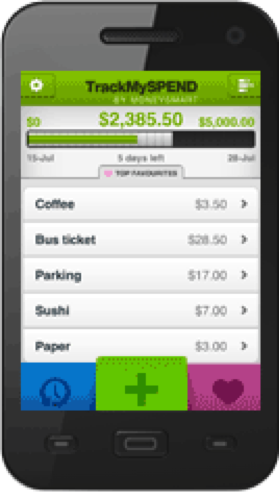

6. Use technology to track your spending on the go

Another FREE app is TrackMySPEND, which works in tandem with the TrackMyGoals app. This app allows people to see where their money is going, identify areas they can save and assists to take control of their finances.

Download the TrackMySPEND app here.

TrackMySpend helps consumers do this:

- Track expenses such as the weekly household budget, special events (e.g. Weddings), work and travel expenses and cash buys such as coffees, lunches and eating out expenses

- Helps nominate a time specific spending limit (per week, fortnight, month or year) and track your progress

- Separates ‘needs’ and ‘wants’ to identify opportunities to save

- Creates ‘favourites’ for tracking frequent expenses

- Features including viewing history, adding tags, categories, applying spending limits, setting reminders via SMA and auto-filling expenses for ease of use

Resources:

About Money Smart

ASIC‘s Money Smart website provides free and impartial information and guidance about

all aspects of personal finance to help Australians make informed financial decisions.

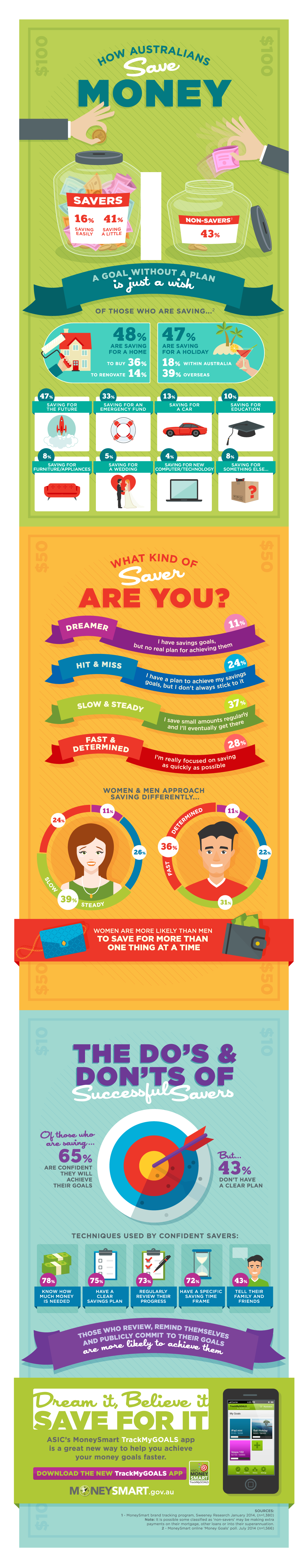

Five things people are saving for

- 48% are saving to buy or renovate a home

- 47% are saving for a holiday

- 47% are saving for the future

- 33% are saving an emergency fund

- 13% are saving for a car

Source: Money Smart

Here’s a visual of how Australian’s are saving money:

Source: Money Smart

This post was sponsored by ASIC’s MoneySmart website

MoneySmart provides free and impartial information and guidance about all aspects of personal finance to help Australians make informed financial decisions. Visit them at moneysmart.gov.au.

YOU

YOU

Money

Money

FOOD

FOOD

FAMILY LIFE

FAMILY LIFE

HOME & GARDEN

HOME & GARDEN

ORGANISE

ORGANISE

EVENTS

EVENTS

LIFESTYLE

LIFESTYLE